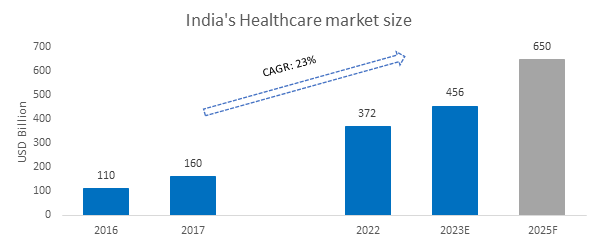

Healthcare is one of India’s major sectors of employment with a current workforce of 4.71 million people and around 0.5 million being added annually. And with industry growth more than 22.5% CAGR since 2016, it has become one of the country’s largest sectors.

Large government-driven initiatives and both public and private investments are unlocking a new horizon of opportunity – with a promising outlook for Swedish life science specialists who can contribute to India’s plan of upgrading infrastructure and making healthcare more affordable and accessible.

Overall, India’s healthcare market was valued at USD 3722 billion in 2022 and is expected to reach USD 650+ billion by end of 2025. The biggest advances are currently being made in sub-sectors such as hospitals and services, pharmaceuticals and medical technology.

GOVERNMENT PUSH TO ACCELERATE CHANGE

India’s government is rolling up its sleeves to address the challenge of improving healthcare resources and making them more available. This is no surprise given the demographic shift – India is today the world’s most populous country. This means that India needs to improve several the critical healthcare indexes when compared with global averages.

According to the World Bank, there are 0.9 physicians per 1,000 people in India, while the global average is 1.8. Hospital beds per 1,000 people is 0.5 and the target is to reach 3.5.

To bridge this gap and provide affordable and accessible healthcare to everyone, the Government of India has consistently increased public health expenditure year-on-year. In 2022, expenditure was USD 63 billion, or 2.1% of GDP, putting the government on track to reach its target of 2.5% by 2025.

Another challenge facing India is the high Out-of-Pocket Expenses by its citizens owing to low penetration of public and private insurance coverage. However, with increasing government health expenditure, OOE has seen significant improvement over past couple of years, dropping markedly from 64.2% in 2013-14 to 48.2% in 2019-20.

AYUSHMAN BHARAT – THE FLAGSHIP SCHEME

A critical component of the public health expenditure is Ayushman Bharat, the flagship scheme to achieve the vision of Universal Health Coverage (UHC), which has seen strong momentum on the ground, manifested by for example setting up primary healthcare centres and providing basic medical coverage for over 500 million people.

In addition, conducive policies for encouraging Foreign Direct Investment (FDI), tax benefit initiatives by the government and favourable policies, coupled with promising growth prospects, have helped the industry attract investments from foreign players.

FIVE HOTSPOTS FOR SWEDISH HEALTHCARE PLAYERS

Investments are ramping up across many sub-sectors in India’s healthcare system. For Swedish healthcare players, the most relevant opportunities lie in the following five areas:

Hospitals: India is making major investments to upgrade medical infrastructure where both public and private players are joining forces. Over the past four years, some 117,000 new Health and Wellness Centres have been set-up by the government.

Besides this, 15 of the 22 national level medical institutions (AIIMS) have become operational in last five years.

Ove the past six years, India’s hospitals have seen investments catapult six-fold, primarily with engagement from private equity players, amounting to USD 4 billion in 2023. As revenues soar for private hospital chains, these stakeholders are also ramping up investments to expand their footprint beyond Tier 1. Fortis, DM Healthcare, Manipal, Apollo are just a few examples.

Home care: With the growing burden of non-communicable diseases, demand for home care has risen sharply in India. NCDs accounted for more than 60% of deaths in 2020 and the trend is expected to grow further. A shortage of skilled healthcare professionals and hospital beds calls for the adoption of more in-home healthcare across the country.

The increased adoption of smartphones, digital platforms and tools are further fuelling demand for more e-healthcare alternatives.

Pharmaceuticals: The increased affordability and accessibility of healthcare is driving consumption of generic and specialised drugs. India is already one of the largest manufacturers of generic drugs worldwide and is further bumping up investments to become a global leader in API and vaccine manufacturing.

Policy incentives from the government and increased collaboration between Indian and global players in manufacturing are also unlocking opportunities for equipment suppliers to to help expand pharmaceuticals manufacturing.

Diagnostics: As healthcare infrastructure improves across the country, medium to large scale diagnostic centres are emerging in Tier 2 and Tier 3 cities. Rising disposable income and screening programmes sponsored by employers are driving an accelerating demand for diagnostics services in all parts of the country.

The biggest demand is found in high-fidelity diagnostics, remote diagnostics, radiology, imaging and cancer detection, to mention just a few areas seeing promising growth.

Medical devices: Strong demand for high-end medical devices and treatments is being driven overwhelmingly by major investments in healthcare infrastructure, but also by advancements in medical technology and the introduction of innovative devices by domestic as well as foreign medical companies.

SWEDISH PLAYERS ARE RAMPING UP

While hospitals and pharmaceuticals still dominate the growth landscape, medical devices and diagnostics have expanded rapidly in recent past and can become the next frontier for Swedish healthcare technology companies.

Many Swedish healthcare innovators have found success by adopting India-specific strategies. One example is a leading pharmaceutical company that has leveraged India’s low-cost R&D expertise together with a skilled workforce. Another example is a Swedish manufacturer of diagnostic devices that has shifted its manufacturing base to India to serve local as well as global demand. A third case in point is a Swedish hospital stakeholder which recently entered India is expanding operations to Tier 2 and Tier 3 locations to cater to capture the untapped market potential.

TEAMING UP FOR IMPACT

The India Sweden Healthcare Innovation Centre is a vehicle for promoting cross-country collaboration in innovative healthcare areas. The initiative was launched by Business Sweden India together with two leading healthcare institutions and Team Sweden partners.

The initiative has been developed on the foundation of the long-standing MoU between India and Sweden, which facilitates strategic joint efforts to bring together relevant stakeholders to form partnerships and address India’s healthcare challenges. The initiative aims to foster collaboration to drive innovative technology solutions and co-create new patient pathways (including development of Centres of Excellence) as well as upskilling and capacity building for nurses.

TIME TO JOIN THE JOURNEY

Some Swedish companies are benefitting considerably by joining this collaboration platform to expand their footprint across India’s healthcare ecosystem.

Want to know more? Check out www.indiaswedenic.com and contact our local team. With our local knowledge and vast contact network, we can help you jumpstart your journey to capture the opportunities of India’s healthcare boom.